Binance: Your Gateway to Financial Freedom

How to Make Profit from Cryptocurrencies on Binance Platform

Making profit from cryptocurrencies on the Binance platform can be achieved through a variety of methods, including active trading, long-term holding, and passive income programs such as savings and staking. Binance, as the world's largest cryptocurrency exchange by trading volume, provides multiple tools for users to maximize their digital assets, but success requires deep market understanding and wise risk management.

What is Binance Platform?

Binance was founded in 2017 and quickly became the leading global exchange by trading volume. It is not merely a place to buy and sell cryptocurrencies like Bitcoin and Ethereum, but rather an integrated ecosystem offering diverse financial services. These services include spot and futures trading, launchpads for new projects, savings and staking programs, as well as a marketplace for non-fungible tokens (NFTs) and more. This diversity of services makes it an attractive destination for both beginners and professionals alike, where each user can find the method that suits their goals and risk tolerance.

Image source: Finance platform Dashboard interface shoping portfolio overview and navigation menu

Before diving into profit strategies, every new user must create and secure an account. The process begins with registration using email or phone number, followed by identity verification (KYC) which requires submitting personal documents. This step is necessary for compliance with international anti-money laundering regulations and increases your withdrawal and deposit limits. After account verification, it's essential to enable security measures such as two-factor authentication (2FA) using an app like Google Authenticator, adding an extra layer of protection for your account and funds from unauthorized access.

Basic Methods for Profiting from Binance

Once your account is set up and funded, you can begin exploring profit-making methods. These methods generally fall into two categories: active profit requiring continuous monitoring and effort, and passive profit that generates income with minimal daily intervention.

You can complete this step here

Trading

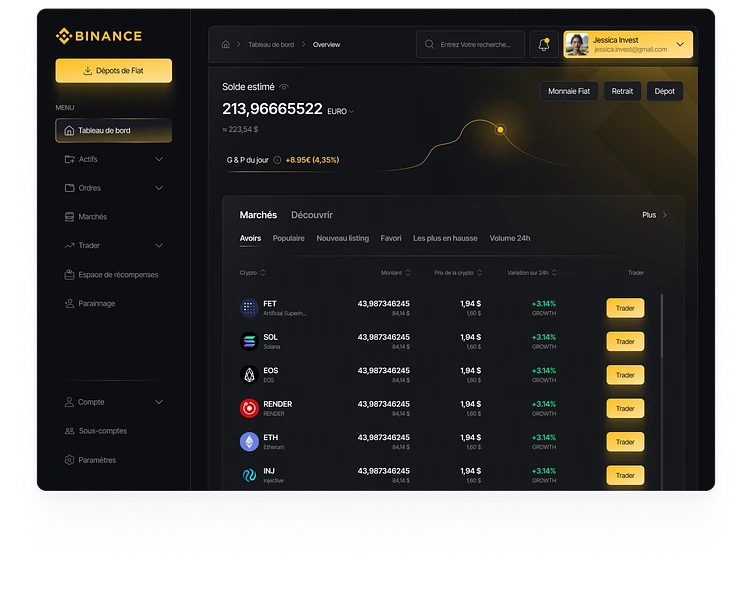

Image source: Comprehensive candlestick patterns and technical analysis chart for cryptocurrency trading

Trading is the most widespread and direct method for attempting to profit from cryptocurrency price fluctuations. The basic principle relies on buying a currency at a low price and selling it at a higher price.

Spot Trading: This is the fundamental form of trading where you buy and sell actual digital assets. You own the currencies you purchase and can withdraw them to your private wallet. Spot market traders rely on technical analysis (studying charts and indicators) and fundamental analysis (evaluating the project itself, its technology, and team) to make their decisions.

Futures Trading: This type of trading allows you to bet on the future price movement of a cryptocurrency without actually owning it. The main advantage here is leverage, which allows you to open positions much larger than your actual capital. For example, leverage of 10x10x means you can control a $1,000 position using only $100. While this multiplies potential profits, it also multiplies potential losses and may lead to complete "liquidation" of your position (losing the initial capital of the trade). Therefore, futures trading is considered high-risk and not recommended for beginners.

Long-term Holding (HODLing)

The term "HODL" is a common term in the cryptocurrency community that simply means holding cryptocurrencies for a long period, ignoring short-term market fluctuations. This strategy is built on the belief that the asset's value will increase significantly over the long term. Investors who follow this approach typically choose strong projects with solid fundamentals, such as Bitcoin (BTC) and Ethereum (ETH), and hold them for years. This approach requires strong patience and the ability to endure sharp market downturns without selling out of fear.

Staking

Image source: Collection of various cryptocurrency coins including Bitcoin, Ethereum, Binance Coin, and other digital assets

If you plan to hold your digital currencies long-term, staking can be an excellent way to generate passive income from them instead of leaving them idle in your wallet. Staking works with currencies that use the "Proof of Stake" (PoS) consensus mechanism. By staking your coins, you contribute to the security and operation of the network, and in return, the network rewards you with additional coins. Binance provides a simplified staking service where the platform handles the technical aspects on your behalf. All you need to do is choose the currency you want to stake and set the duration, and you'll start receiving rewards periodically.

Passive Income Opportunities through Binance Earn

Binance provides a complete section dedicated to growing your digital assets passively, called "Binance Earn." This section offers diverse products suitable for different risk tolerance levels.

Savings

This product works similarly to a traditional bank savings account, but with cryptocurrencies.

Flexible Savings: You can deposit your cryptocurrencies and earn daily interest. The major advantage here is flexibility, where you can withdraw your funds anytime without any penalties. Returns are usually lower than other options, but it's a safe and low-risk choice.

Locked Savings: Here, you agree to "lock" your currencies for a specified period (for example, 30, 60, or 90 days). In exchange for giving up immediate liquidity, you receive a much higher interest rate than flexible savings. This option is suitable for investors who don't plan to sell their assets in the near future.

Launchpool

Launchpool is an exciting way to earn tokens from new projects before they are listed for public trading. You can participate by staking specific currencies like BNB (Binance's native coin) or BUSD (Binance's digital dollar) in dedicated "pools." In return, you'll receive tokens from the new project as rewards throughout the "farming" period. It's a relatively low-risk way to discover new projects and get their tokens for free.

Dual Investment

This is a more complex product that offers very high returns but comes with additional risks. It allows you to deposit a cryptocurrency and earn high returns based on two assets. At maturity, your investment will be settled in one of the two currencies based on whether the market price is above or below the target price you set. This product is designed for advanced users who understand market dynamics well.

Risk Management: The Key to Success

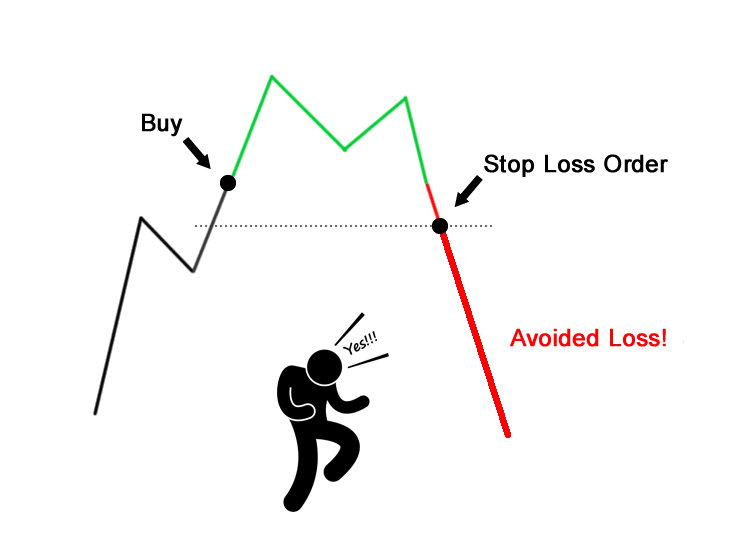

Image source: Stop-loss and take profit trading concept illustration showing risk management strategies

One cannot discuss cryptocurrency profits without emphasizing the importance of risk management. The crypto market is extremely volatile and prices can change dramatically within minutes.

Don't invest more than you can afford to lose: This is the first golden rule. The money you invest in cryptocurrencies should be surplus to your basic needs.

Diversification: Don't put all your money in one currency. Distribute your investments across different projects to reduce the impact of any single project's failure on your overall portfolio.

Using Stop-Loss Orders: When trading, you can set an order to automatically sell the asset if its price drops to a certain level. This helps protect your capital from large losses.

Do Your Own Research (DYOR): Before investing in any currency, do your own research. Read about the project, its team, technology, and use cases. Don't rely blindly on others' advice.

Beware of FOMO and FUD: Don't make investment decisions based on Fear of Missing Out (FOMO) or Fear, Uncertainty, and Doubt (FUD). Emotional trading often leads to losses.

Image source: Stop-loss order visualization showing how it prevents further losses in trading

Conclusion

Binance platform offers a wide range of opportunities to profit from the cryptocurrency world, from active trading to various passive income strategies. However, success in this field is not guaranteed and requires patience, continuous learning, and discipline in risk management. By understanding the different available methods and choosing strategies that align with your financial goals and risk tolerance, you can begin your journey toward exploiting the possibilities this exciting market offers. Always remember to start small, learn gradually, and prioritize the security of your assets.

The cryptocurrency market presents both tremendous opportunities and significant risks. Whether you choose active trading, long-term holding, or passive income strategies through Binance Earn, the key to success lies in education, proper risk management, and maintaining realistic expectations. As the cryptocurrency ecosystem continues to evolve, platforms like Binance will likely introduce new features and opportunities, making it essential to stay informed and adapt your strategies accordingly.